Do you really need to put labels on every data point? Too much text clutters up your graph, overwhelming readers.

data visualization checklist

How to Rock the Text in your Data Visualization

You only get a little bit of text in your graph. Here’s how to make sure you get the most mileage out of it.

Announcing The Interactive Data Visualization Checklist

If you’ve been anywhere near the world of graph making in the past several years, at some point someone probably sent you the Data Visualization Checklist, developed first in 2014 by me and Ann Emery. We built the checklist based on the best available research I was seeing via…

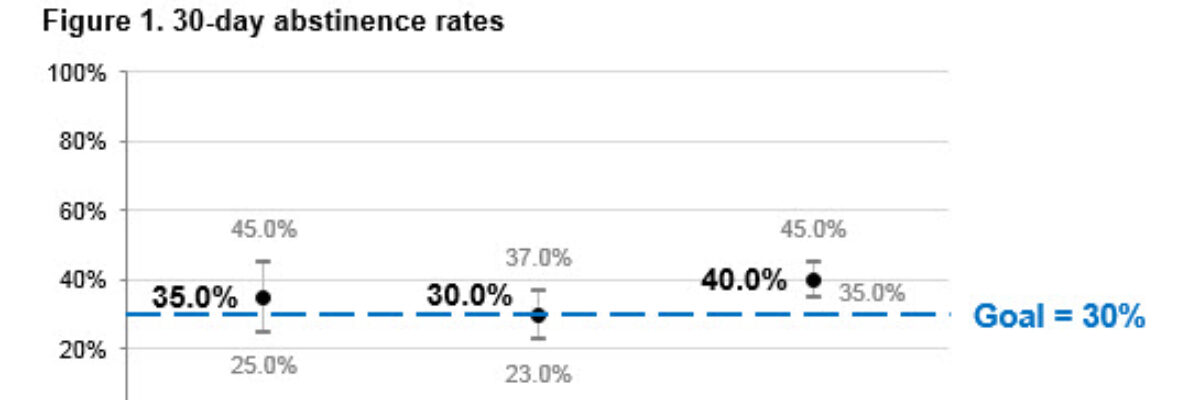

Guest Post – Charting Confidence Intervals

Hi there! I’m Angie Ficek and I’m a program evaluator at a small evaluation consulting firm called Professional Data Analysts, Inc. (PDA) in Minneapolis, MN. In a previous post, Stephanie wrote about adding standard deviations to a dataviz. I responded to her post with an example of…

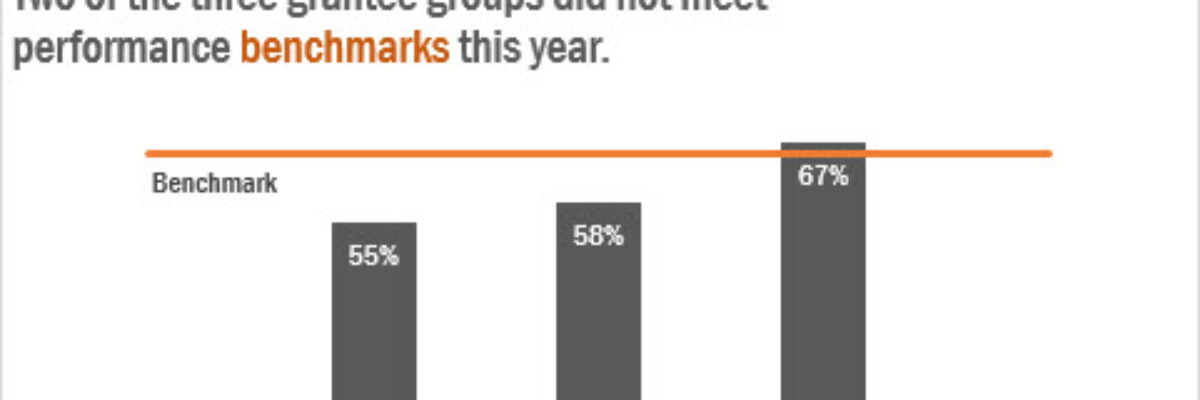

Adding a Benchmark Line to a Graph

This simple line packs so much power. Adding a benchmark line to a graph gives loads of context for the viewer. Here’s how to make one right inside Excel. It’s so easy you might pass out. My data table looks like this: I have my data and I have the benchmark…

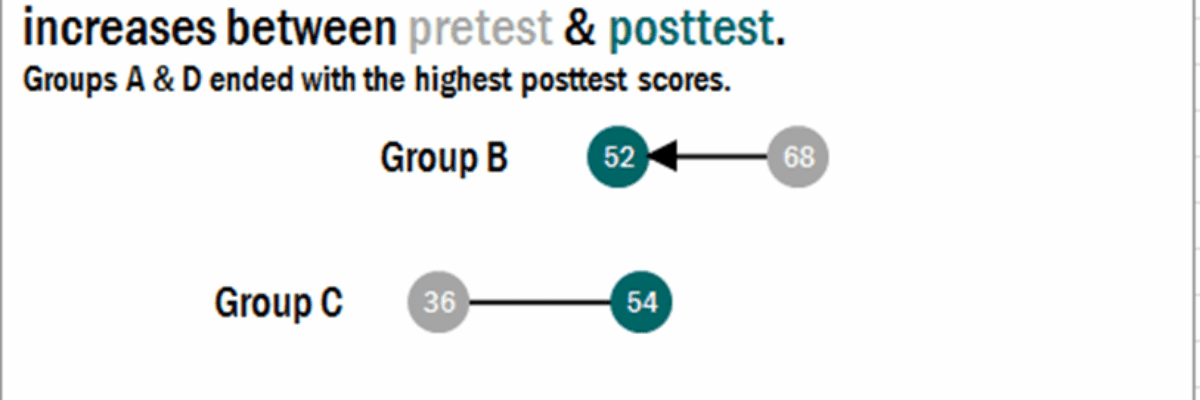

How to Make Horizontal Dumbbell Dot Plots in Excel

In case it wasn’t clear, I freakin love dot plots. They are amazingly easy to read, beautifully simple in their display. I was making these babies for some clients a little while ago, before and after dots for about 25 variables in one graph.